Funds

ALX SCA SICAV SIF. Offers three compartments devoted to Fixed Income, Alternatives and Fund of Funds strategies.

ALX HEREDA SCA RAIF-SICAV aims to invest in vacant inheritances in Spain.

What is an Alternative Investment?

An alternative investment is an investment in assets different from cash, stocks, and bonds.

There are four categories of alternative assets:

Want more information ?

Contact us !

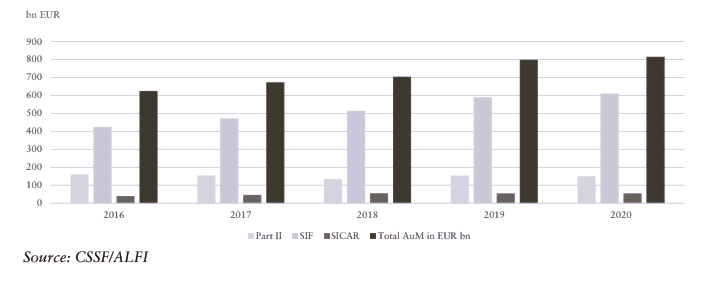

Growth in alternative investement funds

The main features of Alternative Investments are:

- Low correlation with the traditional investments- increasing investors diversification.

- Highly illiquid and less transparent valuations, compared to stocks and bonds.

- Relatively low liquidity

- High purchasing costs (higher minimum investment costs and fees)